How To Get Rich In Real Estate (In 3 Simple Steps)

- September 17, 2019

- Posted by: abgaustralia83

- Category: Taxation and Business Services

The 3-step formula successful investors use to get rich in real estate

I’m often asked, “How can I get rich in real estate?”

Behind this question is a different question, “How can I get the money I need to invest in real estate?”

More often than not, the people asking me these questions have had ingrained into them from an early age that saving was a means to getting rich and that if they wanted to invest, they needed to use their own money. Both are myths that I want to discuss as a foundation on how the rich use debt to get rich in real estate—and how you can too.

The myth of savings as a means to get rich

Is there anything more symbolic about teaching kids about money than this image?

Or perhaps if you were of an older generation, you think of this:

There’s no doubt about it, from an early age we teach our children the value of saving money. “A penny saved; a penny earned,” we chime. And when they are a bit older, we spin tales of the magic of compounding interest. Save enough, children are told, and you’ll be a millionaire by the time you’re ready to retire.

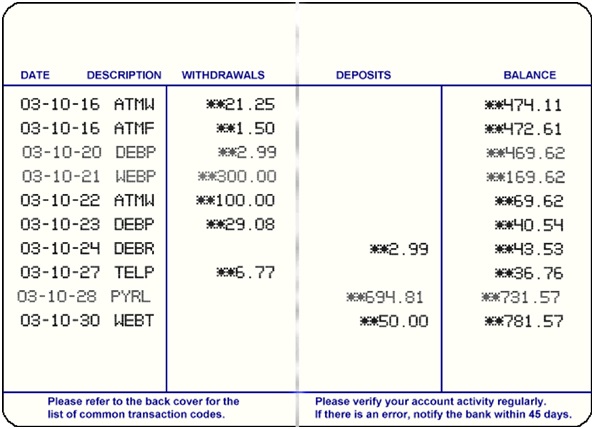

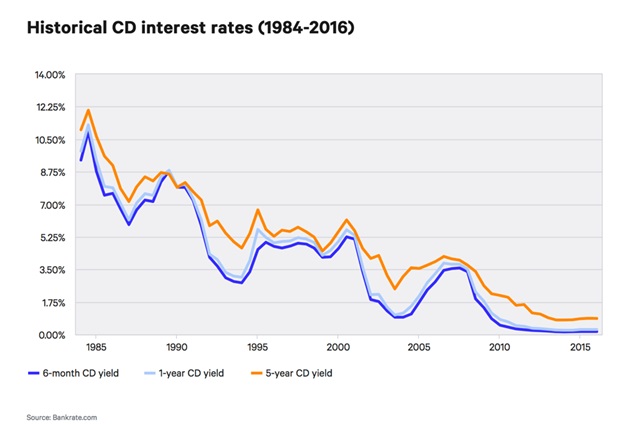

Of course, we don’t tell them about historically low interest rates.

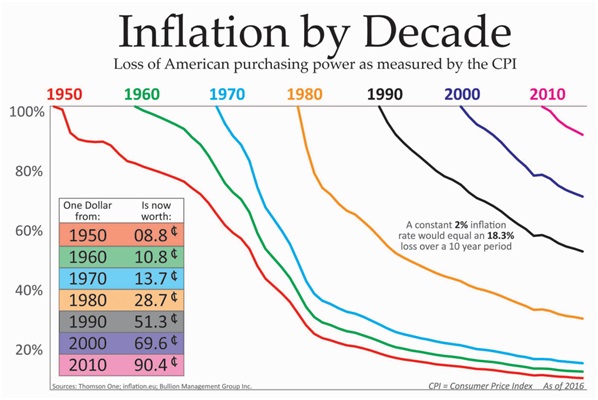

Or the power of inflation to eat away at the value of money over time so that being a millionaire is worthless by the time you retire.

Those are inconvenient financial truths.

It seems as if the “wisdom” to save your money is timeless, in that it won’t go away, even though it’s proven to be wrong. Even today you find “financial experts” who push the save to be a millionaire myth.

The myth: You need money to invest in real estate

The other side of the save to get rich myth is that you need to use your own money (and a lot of it) in order to invest. This is a byproduct of the cultural belief that debt is bad and savings is good. Often, people will say that investing in real estate is risky but if you’re going to do it, try to keep your debt as low as possible. Use your own money and pay off the debt as fast as you can. Nothing could be more wrong. And it stems from a fundamental misunderstanding about debt, which can be both good and bad.

Let’s take a moment to define what I mean by bad debt and good debt.

Bad debt is money that takes money out of your pocket. It makes you poorer. This can be credit card debt from purchases for things like clothes or TVs. And it can even be the mortgage for your personal home. In short, if it’s not making you money, it’s bad debt.

Good debt is another story, and most people aren’t even aware that it exists. Good debt puts money in your pocket month in and month out. “How can this be?” you might ask. Glad you asked. Let’s talk about a concept called OPM or Other People’s Money.

How you can use good debt (OPM) to get rich in real estate

Those who are the most successful investing in real estate understand that the best way to get a high return is to have as little of their own money in a deal.

Rich real estate investors spend their time finding the best deals and then present them to other investors who are willing to use their money to fund the deal. When structured right, OPM allows a real estate investor to secure a valuable, high return, cash-flowing asset for little-to-nothing.

As an example, lets talk about Rich Coach advisor Ken McElroy. Ken is a real estate mogul specializing in apartments—a real estate class called multi-family housing.

1. Find a real estate deal with significant upside

What Ken and his partners do is find apartment buildings that underperform. Because the value of a commercial real estate asset like an apartment is based off the Net Operating Income (income after expenses), any opportunity to increase NOI is an opportunity to see a healthy return.

For Ken and his team, a variety of factors could help with this. For instance:

- The current landlord could be renting units well-below market rates. Turning those units and raising the rent could dramatically increase NOI.

- Retrofitting units with washers and dryers, as well as a cosmetic facelift could increase rents by anywhere from $25 to $50 a month. Multiply that by hundreds of units and you’ll see a big lift in your passive income.

- In many markets it was common to pay for utilities as part of the rent. Changes in the market now make it easier to charge tenants for utilities, which is a huge income opportunity.

2. Package the deal and find investors willing to give you money to be part of it

Once they have a solid business plan in place, Ken and his team form a legal entity called an Pty Ltd for the property and create an investor prospectus. They then go out to investors and raise the capital they need to purchase the property (OPM) by selling shares into the Pty Ltd. Once the asset is secured, they execute on their plan, as well as bring their considerable management expertise to the table.

Already, both Ken and his investors enjoy a good return from the property income since they only purchase cash-flowing assets. This can often be in the double digits. But here’s what separates the rich mindset from the poor one.

3. Refinance the property, give the money back, and do it again

Once the property is substantially increased in value from the business plan, say over a course of three years, Ken and his team refinance the property, pay back all the investors their original capital plus a generous return on that capital, and still have ownership in the building that cash flows each month. And the beauty for Ken and his team is they create this wealth with a little bit of their capital and a bunch of capital from other people. So their returns are higher the whole way through.

At this point, Ken and his investors are enjoying income with no money in the deal. That is an infinite return. And that is why debt infinitely trumps savings.

Anyone (including you) can learn how to get rich in real estate

The good news is you can begin to invest like I outlined above. It might not be with large apartment buildings at first, but it can grow into that.

My friend, Kim, invested with OPM for her first investment—a rental house in Portland, OR. Today, she owns thousands of apartment units. She used this method of good debt to increase the velocity of her money from one small house to a huge portfolio. And you can too. It starts with thinking differently about money, increasing your financial intelligence, and getting to work today.